Uncover The Secrets: Is State Income Tax Deductible?

State income tax deduction refers to the subtraction of state income taxes paid from an individual's federal taxable income. This deduction reduces the amount of income subject to federal income tax, thereby potentially lowering the taxpayer's overall tax liability.

The state income tax deduction is an important provision that can provide significant tax savings, especially for individuals residing in states with high income tax rates. By reducing their federal taxable income, taxpayers can potentially lower their federal income tax bracket, resulting in a smaller tax bill.

The deductibility of state income taxes has been a subject of debate and legal challenges over the years. However, the Tax Cuts and Jobs Act of 2017 imposed a cap on the deduction of state and local taxes (SALT), limiting the amount that individuals can deduct to $10,000.

Read also:260 Sample Sale Mia

Is State Income Tax Deductible?

State income tax deduction is a crucial tax provision that offers potential savings to taxpayers. Here are nine key aspects to consider:

- Definition: Subtracting state income taxes paid from federal taxable income.

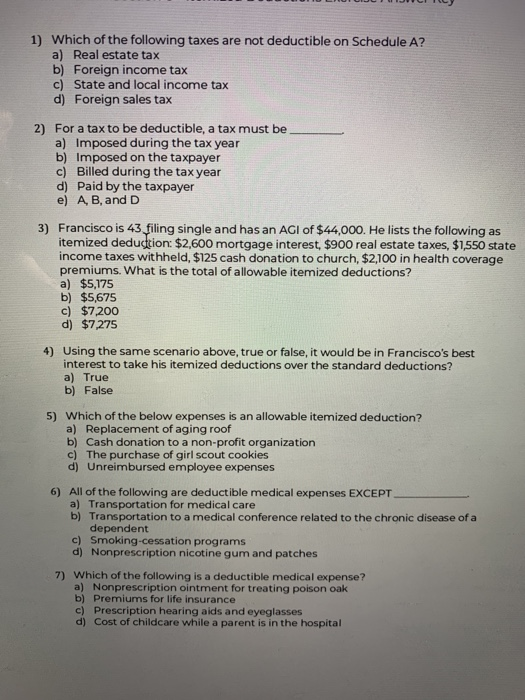

- Eligibility: Itemizing deductions on federal tax returns.

- Benefit: Reduces federal taxable income, potentially lowering tax liability.

- History: Longstanding provision, subject to legal challenges.

- SALT Cap: Tax Cuts and Jobs Act of 2017 imposed a $10,000 cap on SALT deductions.

- Impact: Tax savings vary based on state income tax rates and federal tax bracket.

- Planning: Taxpayers can adjust withholdings to optimize deduction benefits.

- Exceptions: Some states do not have an income tax, making the deduction inapplicable.

- Tax Forms: Schedule A (Form 1040) is used to claim the state income tax deduction.

Understanding these aspects is crucial for taxpayers seeking to maximize their tax savings. By considering their state income tax rates, federal tax bracket, and the SALT cap, individuals can make informed decisions regarding their tax planning and deductions.

Definition

This definition lies at the core of understanding "is state income tax deductible." It outlines the fundamental mechanism through which state income taxes paid can be deducted from an individual's federal taxable income. By reducing their federal taxable income, taxpayers can potentially lower their overall tax liability.

Consider the following example: If an individual has a federal taxable income of $50,000 and has paid $5,000 in state income taxes, they can deduct the $5,000 from their federal taxable income, resulting in a new federal taxable income of $45,000. This reduction can potentially lower their federal income tax bracket, leading to tax savings.

Understanding this definition is crucial for taxpayers seeking to maximize their tax savings. By considering their state income tax rates and federal tax bracket, individuals can make informed decisions regarding their tax planning and deductions.

Eligibility

Itemizing deductions is a crucial aspect of "is state income tax deductible" because it determines whether an individual can deduct their state income taxes on their federal tax return. The Internal Revenue Service (IRS) allows taxpayers to choose between two methods for claiming deductions: the standard deduction or itemizing deductions.

Read also:Jon Bon Jovi Daughter The Untold Story Of A Rock Stars Legacy

- Standard Deduction: A fixed amount that varies depending on the taxpayer's filing status. It is a simpler method that does not require detailed record-keeping.

- Itemizing Deductions: Allows taxpayers to deduct specific expenses from their taxable income. This method requires taxpayers to keep track of their expenses and provide documentation to support their claims.

To claim the state income tax deduction, taxpayers must choose to itemize their deductions. This means that they must list their eligible expenses on Schedule A (Form 1040), which includes state and local income taxes paid.

The decision of whether to itemize deductions or claim the standard deduction depends on the taxpayer's individual circumstances. Taxpayers who have significant eligible expenses may benefit from itemizing, while those with fewer expenses may find the standard deduction to be more beneficial.

Benefit

The connection between "Benefit: Reduces federal taxable income, potentially lowering tax liability." and "is state income tax deductible" is significant because it highlights the primary advantage of deducting state income taxes on federal tax returns. By reducing their federal taxable income, taxpayers can potentially lower their overall tax liability.

Consider the following example: If an individual has a federal taxable income of $50,000 and has paid $5,000 in state income taxes, deducting the state income taxes reduces their federal taxable income to $45,000. This reduction can potentially lower their federal income tax bracket, resulting in tax savings.

The practical significance of understanding this connection lies in the potential financial benefits it offers to taxpayers. By itemizing their deductions and claiming the state income tax deduction, taxpayers can reduce their federal tax liability and increase their after-tax income.

History

The history of state income tax deductibility on federal tax returns is a complex and multifaceted topic with roots in the early 20th century. Understanding this history is crucial for grasping the current legal framework surrounding "is state income tax deductible." Here are some key facets to consider:

- Legal Basis: The deductibility of state income taxes on federal tax returns has been established by various tax laws and court rulings, including the Revenue Act of 1913 and subsequent amendments.

- Legal Challenges: Over the years, the deductibility of state income taxes has faced legal challenges, with some arguing that it violates the principles of federalism and tax equity. However, the Supreme Court has consistently upheld the deduction.

- Political Considerations: The deductibility of state income taxes has also been influenced by political considerations, with some states advocating for its retention to support their revenue systems.

- SALT Cap: The Tax Cuts and Jobs Act of 2017 introduced a cap on the deduction of state and local taxes (SALT), including state income taxes, limiting the amount that individuals can deduct to $10,000.

Understanding these historical and legal aspects is essential for comprehending the current state of "is state income tax deductible." It highlights the legal basis for the deduction, the challenges it has faced, and the political and economic factors that have shaped its evolution.

SALT Cap

The Tax Cuts and Jobs Act of 2017 introduced a significant change to the deductibility of state and local taxes (SALT), including state income taxes. Prior to this legislation, taxpayers could deduct the full amount of their SALT payments on their federal tax returns.

- Impact on State Income Tax Deductibility: The $10,000 cap on SALT deductions effectively limits the amount of state income taxes that individuals can deduct on their federal tax returns. This cap disproportionately affects taxpayers in states with high income tax rates.

- Tax Planning Implications: Taxpayers in high-tax states may need to adjust their tax planning strategies to minimize the impact of the SALT cap. This may involve reducing itemized deductions or increasing withholdings to avoid underpayment penalties.

- Economic Effects: The SALT cap has had a mixed impact on state and local economies. Some states have experienced a decline in revenue as a result of the reduced deductibility of state income taxes, while others have seen an increase in economic activity due to lower overall tax burdens.

- Legal Challenges: The SALT cap has faced legal challenges, with some arguing that it violates the principles of federalism and tax equity. However, the cap remains in effect while these challenges are being adjudicated.

Understanding the SALT cap and its implications is crucial for taxpayers, particularly those residing in high-tax states. By considering the impact on state income tax deductibility, tax planning strategies, and potential economic effects, individuals can make informed decisions to mitigate the impact of this legislation.

Impact

The connection between "Impact: Tax savings vary based on state income tax rates and federal tax bracket." and "is state income tax deductible" lies in the direct impact that state income tax rates and federal tax brackets have on the amount of tax savings an individual can achieve by deducting state income taxes.

To illustrate this connection, consider the following example:

- Scenario 1: An individual residing in a state with a high income tax rate of 6% and a federal tax bracket of 22% may see a significant reduction in their federal tax liability by deducting their state income taxes.

- Scenario 2: Conversely, an individual residing in a state with a low income tax rate of 2% and a federal tax bracket of 12% may see a smaller reduction in their federal tax liability by deducting their state income taxes.

Understanding the impact of state income tax rates and federal tax brackets is crucial for taxpayers seeking to maximize their tax savings. By considering these factors, individuals can make informed decisions regarding whether to itemize their deductions and claim the state income tax deduction.

Planning

Understanding the connection between "Planning: Taxpayers can adjust withholdings to optimize deduction benefits." and "is state income tax deductible" is essential for individuals seeking to maximize their tax savings. By adjusting their withholdings, taxpayers can ensure that they are paying the appropriate amount of taxes throughout the year and avoiding potential penalties or refunds.

- Facet 1: Withholding Allowances

Taxpayers can adjust their withholding allowances on their W-4 form, which determines the amount of income tax withheld from their paychecks. By increasing their withholding allowances, individuals can reduce the amount of taxes withheld each pay period, resulting in a higher take-home pay. This strategy can be beneficial for taxpayers who anticipate claiming itemized deductions, including the state income tax deduction, at the end of the year.

- Facet 2: Estimated Tax Payments

For individuals who have income that is not subject to withholding, such as self-employment income or investment income, making estimated tax payments can help avoid underpayment penalties. By estimating their tax liability and making quarterly estimated tax payments, taxpayers can ensure that they are paying taxes throughout the year and reducing the risk of owing a large amount at tax time. This strategy is particularly important for taxpayers who expect to claim significant deductions, including the state income tax deduction.

Optimizing withholding and estimated tax payments can help taxpayers avoid underpayment penalties and ensure that they are receiving the full benefit of the state income tax deduction. By considering these planning strategies, individuals can maximize their tax savings and improve their overall financial well-being.

Exceptions

The connection between "Exceptions: Some states do not have an income tax, making the deduction inapplicable." and "is state income tax deductible" lies in the fact that the deductibility of state income taxes on federal tax returns is contingent upon the existence of an income tax in the state where the taxpayer resides. If a state does not impose an income tax, then there is no state income tax to deduct on the federal tax return.

The practical significance of this exception is that taxpayers living in states without an income tax, such as Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming, cannot claim the state income tax deduction on their federal tax returns. This can have a significant impact on their overall tax liability, as the state income tax deduction can potentially reduce their federal taxable income and, consequently, their federal income tax liability.

It is important for taxpayers to be aware of this exception when considering their tax planning strategies. If they reside in a state that does not have an income tax, they should be aware that they will not be able to deduct state income taxes on their federal tax returns. This may affect their decision-making regarding itemizing deductions or claiming the standard deduction.

Tax Forms

The connection between "Tax Forms: Schedule A (Form 1040) is used to claim the state income tax deduction." and "is state income tax deductible" is significant because Schedule A (Form 1040) is the specific tax form used by taxpayers to itemize their deductions, including the state income tax deduction. Without using Schedule A (Form 1040), taxpayers cannot claim the state income tax deduction on their federal tax returns.

The practical significance of this understanding is that taxpayers must be aware of the proper tax form to use when claiming the state income tax deduction. If they fail to use Schedule A (Form 1040), they may miss out on the opportunity to reduce their federal taxable income and potentially lower their overall tax liability.

In summary, the use of Schedule A (Form 1040) is an essential component of claiming the state income tax deduction. Taxpayers should carefully follow the instructions provided by the IRS to ensure that they are using the correct tax form and claiming the deduction properly.

FAQs on State Income Tax Deductibility

This section addresses frequently asked questions regarding the deductibility of state income taxes on federal tax returns, aiming to provide clear and concise answers for better understanding.

Question 1: Can I deduct state income taxes on my federal tax return?

Answer: Yes, in most cases. The state income tax deduction allows you to subtract the amount of state income taxes you paid from your federal taxable income, potentially reducing your overall tax liability.

Question 2: How do I claim the state income tax deduction?

Answer: To claim the state income tax deduction, you must itemize your deductions on Schedule A (Form 1040). You cannot claim the deduction if you choose to take the standard deduction.

Question 3: Is there a limit to the amount of state income taxes I can deduct?

Answer: Yes, the Tax Cuts and Jobs Act of 2017 imposed a $10,000 cap on the combined deduction for state and local taxes (SALT), including state income taxes. This cap applies to both single and married taxpayers.

Question 4: What if I live in a state with no income tax?

Answer: If you reside in a state that does not impose an income tax, you cannot deduct state income taxes on your federal tax return because there are no state income taxes to deduct.

Question 5: Can I deduct other state taxes on my federal tax return?

Answer: No, only state income taxes are deductible on federal tax returns. Other state taxes, such as sales tax or property tax, are not deductible.

Question 6: What are the benefits of deducting state income taxes?

Answer: Deducting state income taxes can reduce your federal taxable income, potentially lowering your tax bracket and resulting in tax savings. It can also help offset the impact of high state income tax rates.

Summary: Understanding the deductibility of state income taxes is crucial for maximizing tax savings. By following the rules and using the appropriate tax forms, taxpayers can effectively claim this deduction and reduce their overall tax liability.

Transition: For further information and guidance on state income tax deductibility, refer to the Internal Revenue Service (IRS) website or consult with a tax professional.

Tips Regarding State Income Tax Deductibility

Understanding the deductibility of state income taxes on federal tax returns is crucial for optimizing tax savings. Here are several valuable tips to consider:

Tip 1: Determine Eligibility

To claim the state income tax deduction, you must itemize your deductions on Schedule A (Form 1040). Ensure that itemizing deductions provides greater tax savings compared to taking the standard deduction.

Tip 2: Calculate Potential Savings

Estimate the amount of state income taxes you have paid and calculate the potential tax savings by deducting them from your federal taxable income. Consider the impact on your tax bracket and overall tax liability.

Tip 3: Consider SALT Cap

Be aware of the $10,000 cap on the combined deduction for state and local taxes (SALT), including state income taxes. Plan your deductions accordingly to maximize tax savings within this limit.

Tip 4: File Accurately

Ensure accuracy when reporting your state income tax payments on your federal tax return. Retain documentation of your state income tax payments for future reference.

Tip 5: Seek Professional Advice

If you have complex tax situations or need personalized guidance, consider consulting a tax professional. They can provide tailored advice and help you navigate the complexities of state income tax deductibility.

Tip 6: Stay Informed

Tax laws and regulations may change over time. Stay updated on the latest developments by referring to the Internal Revenue Service (IRS) website or reputable tax resources.

Summary: By following these tips and understanding the nuances of state income tax deductibility, you can effectively reduce your federal tax liability and optimize your tax savings.

Conclusion: State income tax deductibility is a valuable provision that can provide significant tax benefits. By considering these tips and seeking professional guidance when needed, you can maximize the benefits of this deduction and improve your overall financial well-being.

Conclusion

The deductibility of state income taxes on federal tax returns provides a valuable opportunity for taxpayers to reduce their overall tax liability. Understanding the eligibility criteria, potential savings, and relevant tax laws is crucial for maximizing the benefits of this deduction.

Taxpayers should carefully consider their individual circumstances, including their state income tax rates and federal tax bracket, to determine the impact of claiming the state income tax deduction. By planning effectively and seeking professional advice when necessary, individuals can optimize their tax savings and improve their financial well-being.